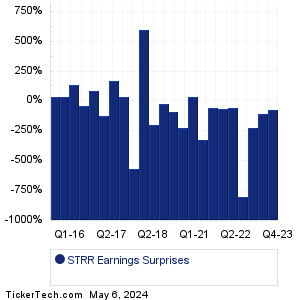

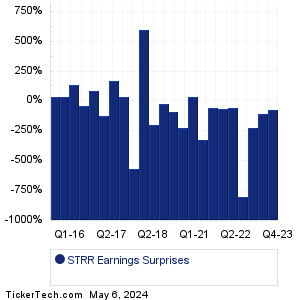

| Star Equity Hldgs Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| Star Equity Hldgs Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| STRR Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| STRR Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| STRR Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:22nd Century Group (XXII): 8/14/2023 6:00 AMRockwell Medical (RMTI): 8/14/2023 6:00 AM Superior Drilling Prods (SDPI): 8/14/2023 6:30 AM Modiv (MDV): 8/14/2023 6:45 AM 2seventy bio (TSVT): 8/14/2023 7:00 AM BioXcel Therapeutics (BTAI): 8/14/2023 7:00 AM Zevra Therapeutics (ZVRA): 8/14/2023 7:00 AM Berkshire Grey (BGRY): 8/14/2023 7:00 AM Broadwind (BWEN): 8/14/2023 7:00 AM Sonida Senior Living (SNDA): 8/14/2023 7:00 AM More from the Next Earnings Dates Calendar Earnings History:Patriot Ntl Bancorp (PNBK): 8/11/2023 6:00 PMPsychemedics (PMD): 8/11/2023 5:00 PM Barnwell Industries (BRN): 8/11/2023 After close vTv Therapeutics (VTVT): 8/11/2023 After close Air T (AIRT): 8/11/2023 After close Global Self Storage (SELF): 8/11/2023 After close Midwest Holding (MDWT): 8/11/2023 After close Jasper Therapeutics (JSPR): 8/11/2023 After close Safe & Green Holdings (SGBX): 8/11/2023 After close Volcon (VLCN): 8/11/2023 After close More from the Earnings History archive |

| Earnings Peers |

| Star Equity Hldgs (STRR) is categorized under the Healthcare sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

STSA Historical Earnings STTK Historical Earnings SUPN Historical Earnings SURF Historical Earnings SVRA Historical Earnings SWAV Historical Earnings SWTX Historical Earnings SYBX Historical Earnings SYK Historical Earnings SYNH Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 7.8%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 7.8%.