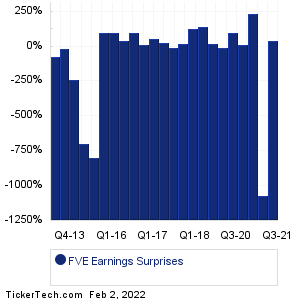

| Five Star Senior Living Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for FVE split history

|

|

|

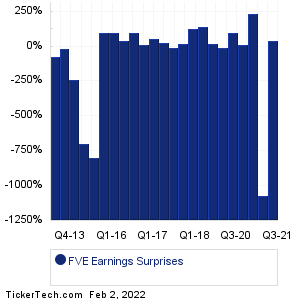

| Five Star Senior Living Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for FVE split history

|

|

|

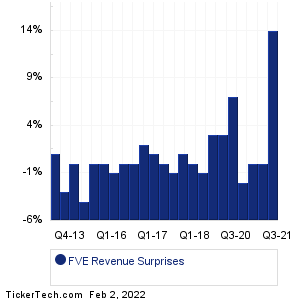

| FVE Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| FVE Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| FVE Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Thermo Fisher Scientific (TMO): 2/2/2022 6:00 AMMarathon Petroleum (MPC): 2/2/2022 6:05 AM Boston Scientific (BSX): 2/2/2022 6:30 AM Humana (HUM): 2/2/2022 6:30 AM IDEXX Laboratories (IDXX): 2/2/2022 6:30 AM D.R. Horton (DHI): 2/2/2022 6:30 AM AmerisourceBergen (ABC): 2/2/2022 6:30 AM Dynatrace (DT): 2/2/2022 6:30 AM Avery Dennison (AVY): 2/2/2022 6:45 AM Capri Holdings (CPRI): 2/2/2022 6:45 AM More from the Next Earnings Dates Calendar Earnings History:Landmark Bancorp (LARK): 2/1/2022 5:00 PMAshland Global Holdings (ASH): 2/1/2022 5:00 PM Littelfuse (LFUS): 2/1/2022 5:00 PM Artisan Partners Asset (APAM): 2/1/2022 After close Owens-Illinois (OI): 2/1/2022 After close Pzena Investment Mgmt (PZN): 2/1/2022 After close Transcat (TRNS): 2/1/2022 After close Horace Mann Educators (HMN): 2/1/2022 After close H&R Block (HRB): 2/1/2022 After close Unum (UNM): 2/1/2022 After close More from the Earnings History archive |

| Earnings Peers |

| Five Star Senior Living (FVE) is categorized under the Healthcare sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

FWBI Past Earnings GALT Past Earnings GBIO Past Earnings GBT Past Earnings GEG Past Earnings GERN Past Earnings GH Past Earnings GILD Past Earnings GKOS Past Earnings GLSI Past Earnings |

Recommended: Institutional Holders of ASHX, Funds Holding CNCO, UCYB Videos.