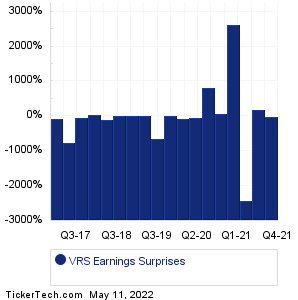

| Verso Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for VRS split history

|

|

|

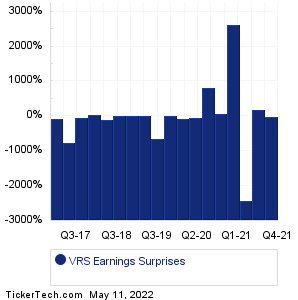

| Verso Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for VRS split history

|

|

|

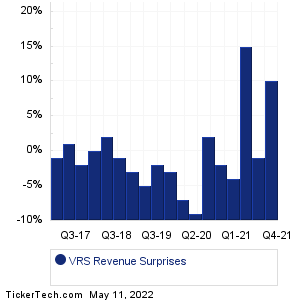

| VRS Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| VRS Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| VRS Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:YETI Holdings (YETI): 5/11/2022 6:00 AMFirst Advantage (FA): 5/11/2022 6:00 AM The Dixie Group (DXYN): 5/11/2022 6:00 AM Wireless Telecom Group (WTT): 5/11/2022 6:00 AM Summit Wireless (WISA): 5/11/2022 6:00 AM Biodesix (BDSX): 5/11/2022 6:00 AM Perrigo Co (PRGO): 5/11/2022 6:30 AM Wolverine World Wide (WWW): 5/11/2022 6:30 AM Krispy Kreme (DNUT): 5/11/2022 6:40 AM Arhaus (ARHS): 5/11/2022 6:40 AM More from the Next Earnings Dates Calendar Earnings History:Ziff Davis (ZD): 5/10/2022 6:00 PMAntares Pharma (ATRS): 5/10/2022 5:17 PM Doma Holdings (DOMA): 5/10/2022 5:10 PM Electromed (ELMD): 5/10/2022 5:05 PM Pixelworks (PXLW): 5/10/2022 5:05 PM Zeta Global Holdings (ZETA): 5/10/2022 5:05 PM Custom Truck One Source (CTOS): 5/10/2022 5:05 PM Flywire (FLYW): 5/10/2022 5:05 PM H&R Block (HRB): 5/10/2022 5:05 PM Tessco Technologies (TESS): 5/10/2022 5:00 PM More from the Earnings History archive |

| Earnings Peers |

| Verso (VRS) is categorized under the Materials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

WLK Past Earnings WMS Past Earnings WOR Past Earnings WRK Past Earnings WST Past Earnings WULF Past Earnings X Past Earnings ZEUS Past Earnings AA Past Earnings ADES Past Earnings |

Recommended: BME Historical Stock Prices, PHM Next Dividend Date, DL market cap history.