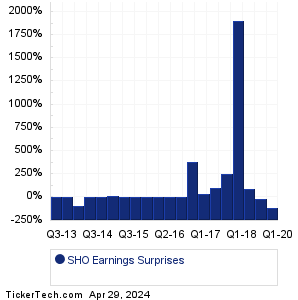

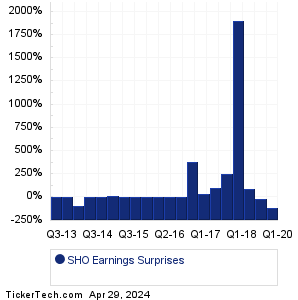

| Sunstone Hotel Investors Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| Sunstone Hotel Investors Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

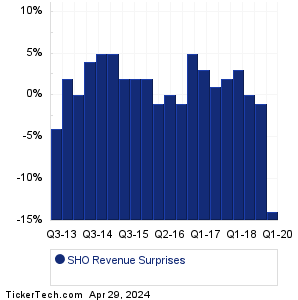

| SHO Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| SHO Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| SHO Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Viatris (VTRS): 8/7/2023 6:00 AMHawaiian Electric Indus (HE): 8/7/2023 6:00 AM TCR2 Therapeutics (TCRR): 8/7/2023 6:00 AM Henry Schein (HSIC): 8/7/2023 6:30 AM Elanco Animal Health (ELAN): 8/7/2023 6:30 AM Freshpet (FRPT): 8/7/2023 6:30 AM Graham (GHM): 8/7/2023 6:30 AM AG Mortgage Investment (MITT): 8/7/2023 6:30 AM KKR & Co (KKR): 8/7/2023 6:50 AM Tyson Foods (TSN): 8/7/2023 6:55 AM More from the Next Earnings Dates Calendar Earnings History:Adtran (ADTN): 8/6/2023 6:46 PMBerkshire Hathaway Inc. Common Stock (BRK-A): 8/5/2023 8:00 AM Berkshire Hathaway Inc. New Common Stock (BRK-B): 8/5/2023 8:00 AM Tennant (TNC): 8/4/2023 9:00 AM DigitalBridge Gr (DBRG): 8/4/2023 8:30 AM Liberty Braves Group (BATRA): 8/4/2023 8:15 AM Liberty Braves Group (BATRK): 8/4/2023 8:15 AM Liberty Broadband (LBRDA): 8/4/2023 8:15 AM Liberty SiriusXM Gr (LSXMA): 8/4/2023 8:15 AM Liberty Formula One Group (FWONA): 8/4/2023 8:15 AM More from the Earnings History archive |

| Earnings Peers |

| Sunstone Hotel Investors (SHO) is categorized under the Financials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

SI Historical Earnings SIEB Historical Earnings SIGI Historical Earnings SITC Historical Earnings SIVB Historical Earnings SKT Historical Earnings SKWD Historical Earnings SLCT Historical Earnings SLG Historical Earnings SLM Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 7.8%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 7.8%.