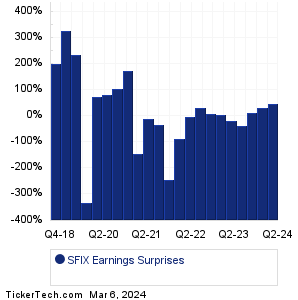

| Stitch Fix Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

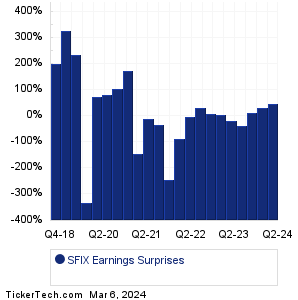

| Stitch Fix Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

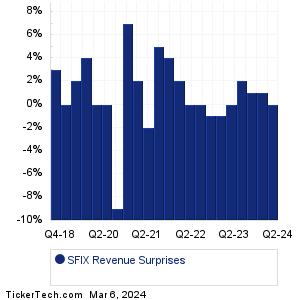

| SFIX Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| SFIX Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| SFIX Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Knife River Holding (KNF): 3/6/2024 5:56 AMEuropean Wax Center (EWCZ): 3/6/2024 6:01 AM Thor Industries (THO): 3/6/2024 6:30 AM Sotherly Hotels (SOHO): 3/6/2024 6:30 AM Korn Ferry (KFY): 3/6/2024 6:45 AM Foot Locker (FL): 3/6/2024 6:45 AM REV Group (REVG): 3/6/2024 7:00 AM Berry Corp (BRY): 3/6/2024 7:00 AM EVgo (EVGO): 3/6/2024 7:00 AM Xeris Biopharma Holdings (XERS): 3/6/2024 7:00 AM More from the Next Earnings Dates Calendar Earnings History:Aquestive Therapeutics (AQST): 3/5/2024 5:05 PMW&T Offshore (WTI): 3/5/2024 After close Bristow Group (VTOL): 3/5/2024 After close Park-Ohio Hldgs (PKOH): 3/5/2024 After close Inspirato (ISPO): 3/5/2024 After close Mayville Engineering (MEC): 3/5/2024 After close Ooma (OOMA): 3/5/2024 After close Greenlight Capital Re (GLRE): 3/5/2024 After close PlayAGS (AGS): 3/5/2024 After close Allient (ALNT): 3/5/2024 After close More from the Earnings History archive |

| Earnings Peers |

| Stitch Fix (SFIX) is categorized under the Services sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

SFM Historical Earnings SFT Historical Earnings SG Historical Earnings SGA Historical Earnings SGMS Historical Earnings SHAK Historical Earnings SIC Historical Earnings SIG Historical Earnings SIRI Historical Earnings SITE Historical Earnings |

Recommended: WPK Videos, PSBH Split History, Funds Holding FRX.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.