| SRCE Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| SRCE Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

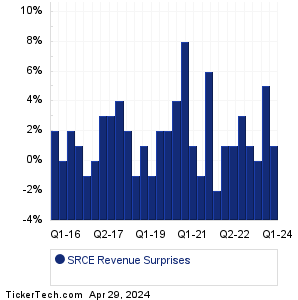

| SRCE Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| SRCE Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| SRCE Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Elevance Health (ELV): 4/18/2024 6:00 AMAlaska Air Gr (ALK): 4/18/2024 6:00 AM Texas Capital Bancshares (TCBI): 4/18/2024 6:00 AM Apogee Enterprises (APOG): 4/18/2024 6:15 AM D.R. Horton (DHI): 4/18/2024 6:30 AM Snap-on (SNA): 4/18/2024 6:30 AM KeyCorp (KEY): 4/18/2024 6:30 AM Forestar Group (FOR): 4/18/2024 6:30 AM Comerica (CMA): 4/18/2024 6:40 AM Genuine Parts (GPC): 4/18/2024 6:55 AM More from the Next Earnings Dates Calendar Earnings History:Great Southern Bancorp (GSBC): 4/17/2024 6:00 PMHome Bancorp (HBCP): 4/17/2024 5:14 PM Synovus Finl (SNV): 4/17/2024 5:00 PM First Industrial Realty (FR): 4/17/2024 After close William Penn (WMPN): 4/17/2024 After close Old Second Bancorp (OSBC): 4/17/2024 After close Liberty Energy (LBRT): 4/17/2024 After close F N B (FNB): 4/17/2024 After close Discover Finl (DFS): 4/17/2024 After close Wintrust Finl (WTFC): 4/17/2024 After close More from the Earnings History archive |

| Earnings Peers |

| 1st Source (SRCE) is categorized under the Financials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

SRG Historical Earnings SSB Historical Earnings SSBI Historical Earnings SSBK Historical Earnings STAG Historical Earnings STAR Historical Earnings STBA Historical Earnings STC Historical Earnings STEL Historical Earnings STEP Historical Earnings |

Recommended: ABBV Insider Buying, Funds Holding HDWM, Funds Holding VAR.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.