| REV Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| REV Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

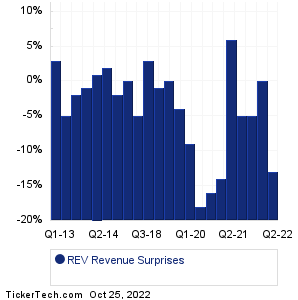

| REV Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| REV Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| REV Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Portland General Electric (POR): 10/25/2022 5:00 AMUnited Parcel Service (UPS): 10/25/2022 6:00 AM Centene (CNC): 10/25/2022 6:00 AM Synchrony Finl (SYF): 10/25/2022 6:00 AM Sensata Technologies (ST): 10/25/2022 6:00 AM Polaris (PII): 10/25/2022 6:00 AM Armstrong World Indus (AWI): 10/25/2022 6:00 AM Southside Bancshares (SBSI): 10/25/2022 6:00 AM Peoples Bancorp (PEBO): 10/25/2022 6:00 AM Provident Financial Hldgs (PROV): 10/25/2022 6:00 AM More from the Next Earnings Dates Calendar Earnings History:Five Star Bancorp (FSBC): 10/24/2022 6:00 PMSouthern Missouri Bancorp (SMBC): 10/24/2022 6:00 PM NorthWestern (NWE): 10/24/2022 6:00 PM Community Financial (TCFC): 10/24/2022 5:46 PM Brown & Brown (BRO): 10/24/2022 5:27 PM Crown Holdings (CCK): 10/24/2022 5:08 PM Crane (CR): 10/24/2022 5:01 PM SmartFinancial (SMBK): 10/24/2022 5:00 PM Independent Bank Gr (IBTX): 10/24/2022 5:00 PM NewMarket (NEU): 10/24/2022 5:00 PM More from the Earnings History archive |

| Earnings Peers |

| Revlon (REV) is categorized under the Consumer sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

REVG Historical Earnings RGR Historical Earnings RIBT Historical Earnings RIDE Historical Earnings RL Historical Earnings RMCF Historical Earnings SAFM Historical Earnings SAM Historical Earnings SANW Historical Earnings SGC Historical Earnings |

Recommended: EDC YTD Return, MORF Average Annual Return, CEMB Options Chain.