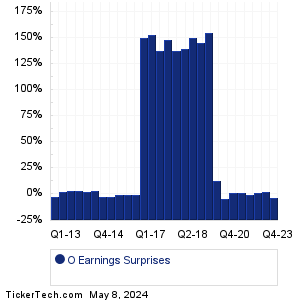

| Realty Income Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

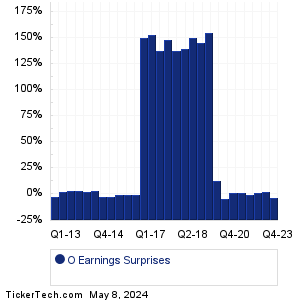

| Realty Income Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

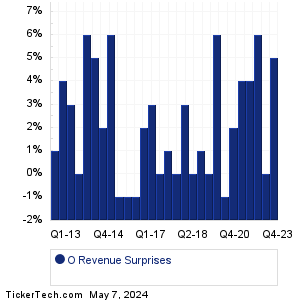

| O Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| O Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| O Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Fastenal (FAST): 4/11/2024 6:00 AMHooker Furnishings (HOFT): 4/11/2024 6:00 AM Conn's (CONN): 4/11/2024 6:00 AM HF Sinclair (DINO): 4/11/2024 6:30 AM CarMax (KMX): 4/11/2024 6:50 AM Lovesac (LOVE): 4/11/2024 7:00 AM Constellation Brands (STZ): 4/11/2024 7:30 AM Northern Technologies (NTIC): 4/11/2024 8:00 AM Kore Group Holdings (KORE): 4/11/2024 8:00 AM Applied Digital (APLD): 4/11/2024 After close More from the Next Earnings Dates Calendar Earnings History:Richardson Electronics (RELL): 4/10/2024 After closeLakeland Industries (LAKE): 4/10/2024 After close Rent the Runway (RENT): 4/10/2024 After close Pure Cycle (PCYO): 4/10/2024 After close Greenidge Generation Hldg (GREE): 4/10/2024 8:00 AM Nurix Therapeutics (NRIX): 4/10/2024 7:00 AM Delta Air Lines (DAL): 4/10/2024 6:30 AM Intensity Therapeutics (INTS): 4/9/2024 After close Aehr Test Systems (AEHR): 4/9/2024 After close SMART Glb Hldgs (SGH): 4/9/2024 After close More from the Earnings History archive |

| Earnings Peers |

| Realty Income (O) is categorized under the Financials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

OBK Historical Earnings OBNK Historical Earnings OBT Historical Earnings OCFC Historical Earnings OCN Historical Earnings OFC Historical Earnings OFED Historical Earnings OFG Historical Earnings OHI Historical Earnings OLP Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.