| RCII Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| RCII Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

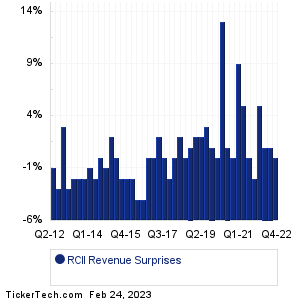

| RCII Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| RCII Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| RCII Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Evergy (EVRG): 2/24/2023 6:00 AMLamar Advertising (LAMR): 2/24/2023 6:00 AM Chart Industries (GTLS): 2/24/2023 6:00 AM PNM Resources (PNM): 2/24/2023 6:00 AM Northwest Natural Holding (NWN): 2/24/2023 6:00 AM US Silica Holdings (SLCA): 2/24/2023 6:00 AM ACM Research (ACMR): 2/24/2023 6:00 AM Carter's (CRI): 2/24/2023 6:05 AM Gray Television (GTN): 2/24/2023 6:25 AM HF Sinclair (DINO): 2/24/2023 6:30 AM More from the Next Earnings Dates Calendar Earnings History:Oceaneering International (OII): 2/23/2023 5:01 PMGranite Point Mortgage (GPMT): 2/23/2023 After close MasTec (MTZ): 2/23/2023 After close Diamond Hill Inv Gr (DHIL): 2/23/2023 After close Ellington Financial (EFC): 2/23/2023 After close Apollo Medical Holdings (AMEH): 2/23/2023 After close Shattuck Labs (STTK): 2/23/2023 After close Olympic Steel (ZEUS): 2/23/2023 After close Kaman (KAMN): 2/23/2023 After close Quaker Chemical (KWR): 2/23/2023 After close More from the Earnings History archive |

| Earnings Peers |

| Rent-A-Center (RCII) is categorized under the Services sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

RDI Historical Earnings REAL Historical Earnings RELY Historical Earnings REZI Historical Earnings RGS Historical Earnings RH Historical Earnings RICK Historical Earnings RIVN Historical Earnings ROKU Historical Earnings ROL Historical Earnings |