| Pool Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| Pool Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

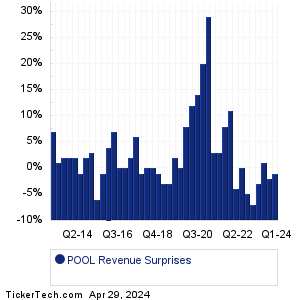

| POOL Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| POOL Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| POOL Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Portland Gen Electric (POR): 4/26/2024 5:00 AMAon (AON): 4/26/2024 6:00 AM Centene (CNC): 4/26/2024 6:00 AM Ball (BALL): 4/26/2024 6:00 AM US Silica Holdings (SLCA): 4/26/2024 6:00 AM Avantor (AVTR): 4/26/2024 6:05 AM Carter's (CRI): 4/26/2024 6:05 AM Chevron (CVX): 4/26/2024 6:15 AM Exxon Mobil (XOM): 4/26/2024 6:30 AM LyondellBasell Industries (LYB): 4/26/2024 6:30 AM More from the Next Earnings Dates Calendar Earnings History:NOV (NOV): 4/25/2024 6:09 PMSJW Gr (SJW): 4/25/2024 6:00 PM NorthWestern (NWE): 4/25/2024 6:00 PM Provident Bancorp (PVBC): 4/25/2024 6:00 PM First of Long Island (FLIC): 4/25/2024 5:21 PM Customers Bancorp (CUBI): 4/25/2024 5:20 PM Minerals Technologies (MTX): 4/25/2024 5:05 PM Primis Finl (FRST): 4/25/2024 5:00 PM AptarGroup (ATR): 4/25/2024 5:00 PM Codorus Valley Bancorp (CVLY): 4/25/2024 After close More from the Earnings History archive |

| Earnings Peers |

| Pool (POOL) is categorized under the Consumer sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

POST Historical Earnings POWW Historical Earnings PPC Historical Earnings PRPL Historical Earnings PTON Historical Earnings PTRA Historical Earnings PVH Historical Earnings RCKY Historical Earnings RCL Historical Earnings REED Historical Earnings |

Recommended: Qualcomm 13F Filers, ETFs Holding CERU, BBY Dividend History.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.