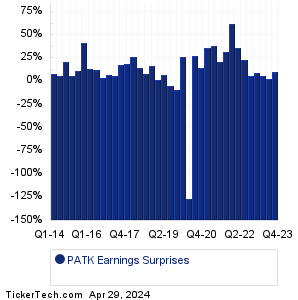

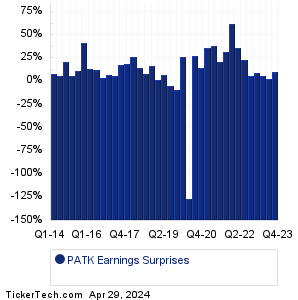

| Patrick Industries Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| Patrick Industries Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

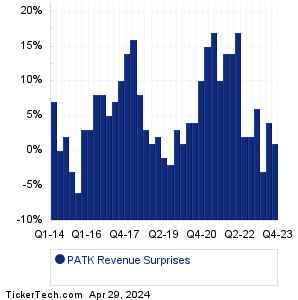

| PATK Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| PATK Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| PATK Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Bullfrog AI Hldgs (BFRG): 4/16/2024 2:33 AMFirst Seacoast Bancorp (FSEA): 4/16/2024 3:00 AM Mercantile Bank (MBWM): 4/16/2024 5:01 AM UnitedHealth Group (UNH): 4/16/2024 5:55 AM Commerce Bancshares (CBSH): 4/16/2024 6:00 AM Elicio Therapeutics (ELTX): 4/16/2024 6:00 AM Johnson & Johnson (JNJ): 4/16/2024 6:20 AM Bank of New York Mellon (BK): 4/16/2024 6:30 AM Bank of America (BAC): 4/16/2024 6:45 AM PNC Finl Servs Gr (PNC): 4/16/2024 6:45 AM More from the Next Earnings Dates Calendar Earnings History:Cryo-Cell International (CCEL): 4/15/2024 5:00 PMTSR (TSRI): 4/15/2024 5:00 PM Novo Integrated Sciences (NVOS): 4/15/2024 After close Jewett-Cameron Trading (JCTCF): 4/15/2024 After close Greenwich LifeSciences (GLSI): 4/15/2024 After close Vuzix (VUZI): 4/15/2024 After close FB Financial (FBK): 4/15/2024 After close Dragonfly Energy Hldgs (DFLI): 4/15/2024 After close CaliberCos (CWD): 4/15/2024 After close Bitcoin Depot (BTM): 4/15/2024 After close More from the Earnings History archive |

| Earnings Peers |

| Patrick Industries (PATK) is categorized under the Consumer sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

PCAR Historical Earnings PEP Historical Earnings PETQ Historical Earnings PG Historical Earnings PHIN Historical Earnings PII Historical Earnings PLBY Historical Earnings PM Historical Earnings POOL Historical Earnings POST Historical Earnings |

Recommended: Funds Holding ACH, Funds Holding BCSA, Institutional Holders of TRIL.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.7%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.7%.