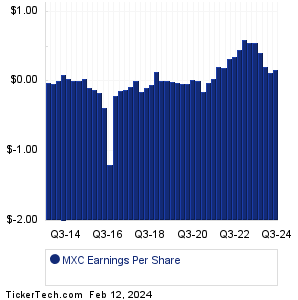

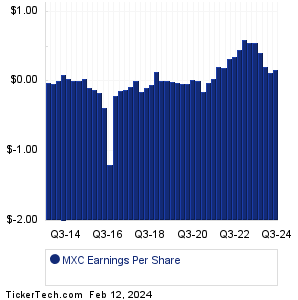

| MXC Earnings History | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| MXC Earnings History | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

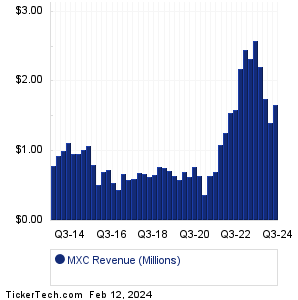

| MXC Revenue History | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| MXC Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| MXC Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Trimble (TRMB): 2/12/2024 6:55 AMBeasley Broadcast Group (BBGI): 2/12/2024 7:00 AM Alexander's (ALX): 2/12/2024 8:00 AM Fortrea Holdings (FTRE): 2/12/2024 9:12 AM Lattice Semiconductor (LSCC): 2/12/2024 After close Federal Realty Investment (FRT): 2/12/2024 After close Vornado Realty (VNO): 2/12/2024 After close 2U (TWOU): 2/12/2024 After close Cadence Design Sys (CDNS): 2/12/2024 After close Arista Networks (ANET): 2/12/2024 After close More from the Next Earnings Dates Calendar Earnings History:AutoZone (AZO): 2/10/2024 6:55 AMAmtech Systems (ASYS): 2/9/2024 After close EVI Industries (EVI): 2/9/2024 8:32 AM Motorcar Parts of America (MPAA): 2/9/2024 8:00 AM Construction Partners (ROAD): 2/9/2024 7:30 AM W.P. Carey (WPC): 2/9/2024 7:30 AM Newell Brands (NWL): 2/9/2024 7:00 AM AMC Networks (AMCX): 2/9/2024 7:00 AM Mr. Cooper Gr (COOP): 2/9/2024 7:00 AM Blue Owl Cap (OWL): 2/9/2024 7:00 AM More from the Earnings History archive |

| Featured Articles |

| Earnings Peers |

Recommended: TMA Split History, WU Historical Earnings, CNXC YTD Return.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.