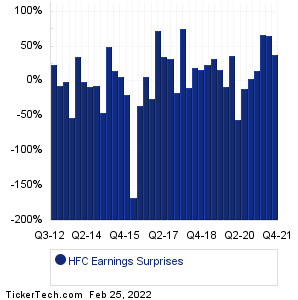

| HollyFrontier Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for HFC split history

|

|

|

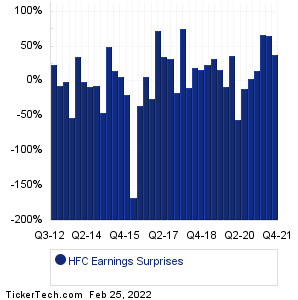

| HollyFrontier Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for HFC split history

|

|

|

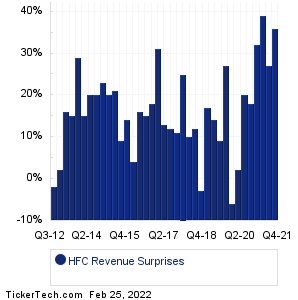

| HFC Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| HFC Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| HFC Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Evergy (EVRG): 2/25/2022 6:00 AMLamar Advertising (LAMR): 2/25/2022 6:00 AM ModivCare (MODV): 2/25/2022 6:00 AM Northwest Natural Holding (NWN): 2/25/2022 6:00 AM City Office REIT (CIO): 2/25/2022 6:00 AM US Silica Holdings (SLCA): 2/25/2022 6:00 AM Ecovyst (ECVT): 2/25/2022 6:15 AM Carter's (CRI): 2/25/2022 6:23 AM Vistra Energy (VST): 2/25/2022 6:30 AM Cinemark Hldgs (CNK): 2/25/2022 6:30 AM More from the Next Earnings Dates Calendar Earnings History:MoneyGram Int (MGI): 2/24/2022 7:30 PMRyman Hospitality (RHP): 2/24/2022 6:34 PM ESS Tech (GWH): 2/24/2022 6:00 PM AES (AES): 2/24/2022 6:00 PM Talos Energy (TALO): 2/24/2022 5:30 PM Ovintiv (OVV): 2/24/2022 5:30 PM Oceaneering International (OII): 2/24/2022 5:01 PM Ashford Inc. Common Stock (AINC): 2/24/2022 After close Granite Point Mortgage (GPMT): 2/24/2022 After close Select Medical Holdings (SEM): 2/24/2022 After close More from the Earnings History archive |

| Earnings Peers |

| HollyFrontier (HFC) is categorized under the Energy sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

HLX Past Earnings HP Past Earnings ICD Past Earnings INT Past Earnings IO Past Earnings KLXE Past Earnings KMI Past Earnings KOS Past Earnings LBRT Past Earnings LPI Past Earnings |

Recommended: Funds Holding RS, DIN Stock Predictions, ETFs Holding TRUE.