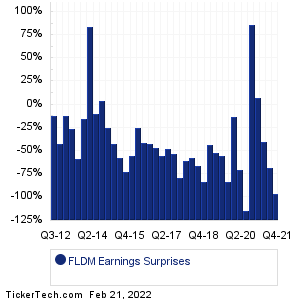

| Fluidigm Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for FLDM split history

|

|

|

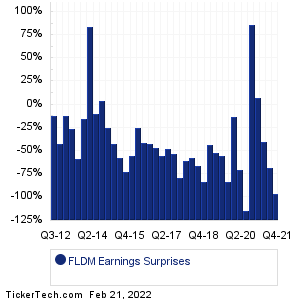

| Fluidigm Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for FLDM split history

|

|

|

| FLDM Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| FLDM Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| FLDM Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:William Penn (WMPN): 2/21/2022 8:00 AMSun Communities (SUI): 2/21/2022 After close Proassurance (PRA): 2/21/2022 After close NexTier Oilfield (NEX): 2/21/2022 After close Apache (APA): 2/21/2022 After close Masonite International (DOOR): 2/21/2022 After close Unisys (UIS): 2/21/2022 After close Williams Companies (WMB): 2/21/2022 After close Helix Energy Solutions Gr (HLX): 2/21/2022 After close HealthStream (HSTM): 2/21/2022 After close More from the Next Earnings Dates Calendar Earnings History:Lions Gate Entertainment Corporation Class B Non-Voting Shares (LGF-B): 2/20/2022 After closeNeuroPace (NPCE): 2/20/2022 4:14 AM HireRight Holdings (HRT): 2/19/2022 5:56 PM Minerva Surgical (UTRS): 2/19/2022 After close GT Biopharma (GTBP): 2/19/2022 7:10 AM Rivian Automotive (RIVN): 2/19/2022 5:03 AM Catalyst Bancorp (CLST): 2/19/2022 3:45 AM Virginia National (VABK): 2/18/2022 5:24 PM First Advantage (FA): 2/18/2022 5:23 PM HV Bancorp (HVBC): 2/18/2022 5:00 PM More from the Earnings History archive |

| Earnings Peers |

| Fluidigm (FLDM) is categorized under the Healthcare sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

FLGT Past Earnings FLXN Past Earnings FMTX Past Earnings FNCH Past Earnings FOLD Past Earnings FONR Past Earnings FREQ Past Earnings FSTX Past Earnings FULC Past Earnings FVE Past Earnings |

Recommended: FLIC market cap history, ITT shares outstanding history, ADM Videos.