| FC Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| FC Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

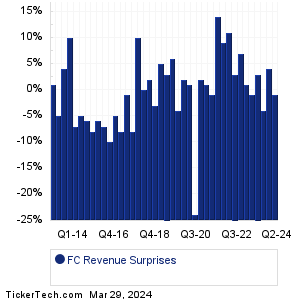

| FC Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| FC Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| FC Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Celsius Holdings (CELH): 3/29/2024 8:00 AMY-mAbs Therapeutics (YMAB): 3/29/2024 After close Escalade (ESCA): 4/1/2024 6:00 AM ZeroFox Holdings (ZFOX): 4/1/2024 6:00 AM Terran Orbital (LLAP): 4/1/2024 6:30 AM Alimera Sciences (ALIM): 4/1/2024 7:00 AM Avrobio (AVRO): 4/1/2024 7:00 AM DecisionPoint Sys (DPSI): 4/1/2024 7:00 AM AlloVir (ALVR): 4/1/2024 7:00 AM Milestone Scientific (MLSS): 4/1/2024 7:00 AM More from the Next Earnings Dates Calendar Earnings History:Predictive Oncology (POAI): 3/28/2024 5:28 PMAqua Metals (AQMS): 3/28/2024 5:21 PM Cadiz (CDZI): 3/28/2024 After close Zevra Therapeutics (ZVRA): 3/28/2024 After close Shapeways Hldgs (SHPW): 3/28/2024 After close Maui Land & Pineapple Co (MLP): 3/28/2024 After close NSTS Bancorp (NSTS): 3/28/2024 After close Verde Clean Fuels (VGAS): 3/28/2024 After close Semtech (SMTC): 3/28/2024 After close Pulse Biosciences (PLSE): 3/28/2024 After close More from the Earnings History archive |

| Earnings Peers |

| Franklin Covey (FC) is categorized under the Industrials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

FCEL Historical Earnings FCN Historical Earnings FDX Historical Earnings FELE Historical Earnings FICO Historical Earnings FIP Historical Earnings FIS Historical Earnings FIX Historical Earnings FLOW Historical Earnings FLR Historical Earnings |

Recommended: HNP Options Chain, SNSR Options Chain, DE Average Annual Return.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.