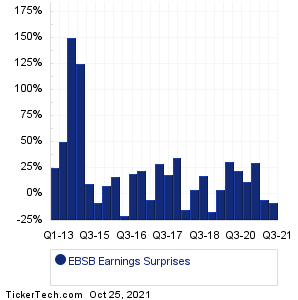

| EBSB Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for EBSB split history

|

|

|

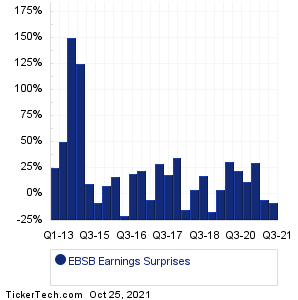

| EBSB Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for EBSB split history

|

|

|

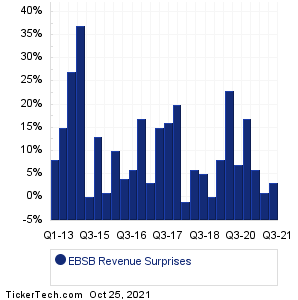

| EBSB Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| EBSB Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| EBSB Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Otis Worldwide (OTIS): 10/25/2021 6:00 AMHBT Financial (HBT): 10/25/2021 6:00 AM SITE Centers (SITC): 10/25/2021 6:30 AM Bank of Hawaii (BOH): 10/25/2021 6:45 AM First BanCorp (FBP): 10/25/2021 7:00 AM Dorman Products (DORM): 10/25/2021 7:00 AM Kimberly-Clark (KMB): 10/25/2021 7:30 AM Lennox International (LII): 10/25/2021 7:30 AM Atlantic Union Bankshares (AUB): 10/25/2021 7:30 AM HNI (HNI): 10/25/2021 7:30 AM More from the Next Earnings Dates Calendar Earnings History:NorthWestern (NWE): 10/24/2021 6:00 PMEmclaire Financial (EMCF): 10/22/2021 After close Penns Woods Bancorp (PWOD): 10/22/2021 12:54 PM Peoples Financial Servs (PFIS): 10/22/2021 12:51 PM MetroCity Bankshares (MCBS): 10/22/2021 9:52 AM Greene County Bancorp (GCBC): 10/22/2021 9:48 AM 1st Constitution (FCCY): 10/22/2021 9:00 AM Tompkins Financial (TMP): 10/22/2021 9:00 AM First Capital (FCAP): 10/22/2021 8:00 AM Blue Foundry (BLFY): 10/22/2021 8:00 AM More from the Earnings History archive |

| Earnings Peers |

| Meridian Bancorp (EBSB) is categorized under the Financials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

EBTC Past Earnings ECPG Past Earnings EEFT Past Earnings EFC Past Earnings EFSC Past Earnings EGBN Past Earnings EGP Past Earnings EHTH Past Earnings EIG Past Earnings ELS Past Earnings |