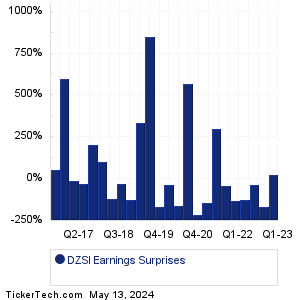

| DZS Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

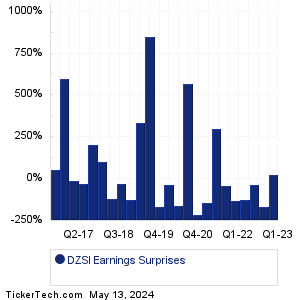

| DZS Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

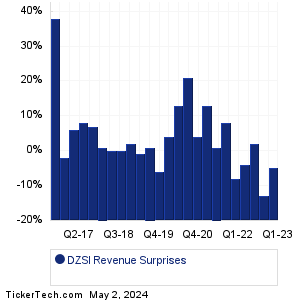

| DZSI Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| DZSI Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| DZSI Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Coherent (COHR): 5/10/2023 6:00 AMSyneos Health (SYNH): 5/10/2023 6:00 AM Global Net Lease (GNL): 5/10/2023 6:00 AM First Advantage (FA): 5/10/2023 6:00 AM LifeStance Health Gr (LFST): 5/10/2023 6:00 AM CURO Group Holdings (CURO): 5/10/2023 6:00 AM Everi Hldgs (EVRI): 5/10/2023 6:15 AM First Citizens BancShares (FCNCA): 5/10/2023 6:30 AM Hecla Mining (HL): 5/10/2023 6:30 AM Wolverine World Wide (WWW): 5/10/2023 6:30 AM More from the Next Earnings Dates Calendar Earnings History:Mesa Air Gr (MESA): 5/9/2023 5:34 PMPsychemedics (PMD): 5/9/2023 5:30 PM Ziff Davis (ZD): 5/9/2023 5:30 PM Hyliion Holdings (HYLN): 5/9/2023 5:23 PM Atlanticus Holdings (ATLC): 5/9/2023 5:22 PM Legacy Housing (LEGH): 5/9/2023 5:15 PM Skyward Specialty (SKWD): 5/9/2023 5:07 PM Ovintiv (OVV): 5/9/2023 5:05 PM Maiden Hldgs (MHLD): 5/9/2023 5:00 PM Granite Point Mortgage (GPMT): 5/9/2023 After close More from the Earnings History archive |

| Earnings Peers |

| DZS (DZSI) is categorized under the Technology sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

EA Historical Earnings EB Historical Earnings EBIX Historical Earnings ECOM Historical Earnings EGAN Historical Earnings EGHT Historical Earnings EGIO Historical Earnings EMKR Historical Earnings ENFN Historical Earnings ENPH Historical Earnings |

Recommended: Institutional Holders of XYN, QINC Options Chain, MCG Insider Buying.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 7.8%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 7.8%.