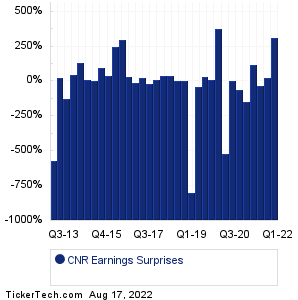

| Cornerstone Building Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

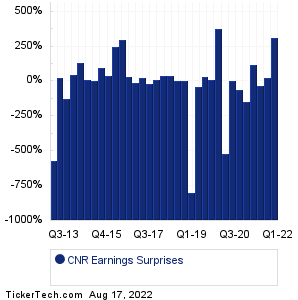

| Cornerstone Building Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

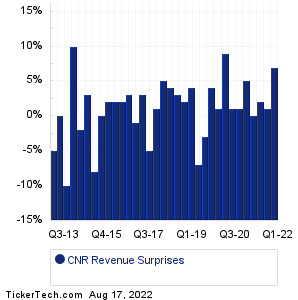

| CNR Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| CNR Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| CNR Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Lowe's Companies (LOW): 8/17/2022 6:00 AMTarget (TGT): 8/17/2022 6:30 AM Krispy Kreme (DNUT): 8/17/2022 6:40 AM Crown Crafts (CRWS): 8/17/2022 6:45 AM Analog Devices (ADI): 8/17/2022 7:00 AM Performance Food Group (PFGC): 8/17/2022 7:00 AM Children's Place (PLCE): 8/17/2022 7:00 AM Genius Brands Intl (GNUS): 8/17/2022 7:00 AM TJX Companies (TJX): 8/17/2022 7:30 AM Keysight Technologies (KEYS): 8/17/2022 After close More from the Next Earnings Dates Calendar Earnings History:Lulus Fashion Lounge (LVLU): 8/16/2022 After closeAgilent Technologies (A): 8/16/2022 After close LM Funding America (LMFA): 8/16/2022 After close Aridis Pharmaceuticals (ARDS): 8/16/2022 After close Stronghold Digital Mining (SDIG): 8/16/2022 After close PAVmed (PAVM): 8/16/2022 After close QuickLogic (QUIK): 8/16/2022 After close Jack Henry & Associates (JKHY): 8/16/2022 After close AgEagle Aerial Systems (UAVS): 8/16/2022 8:30 AM Cyclo Therapeutics (CYTH): 8/16/2022 8:05 AM More from the Earnings History archive |

| Earnings Peers |

| Cornerstone Building (CNR) is categorized under the Materials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

CPSH Historical Earnings CRS Historical Earnings CSL Historical Earnings CSTM Historical Earnings CSWI Historical Earnings DD Historical Earnings DNMR Historical Earnings DOW Historical Earnings DOX Historical Earnings EAF Historical Earnings |

Recommended: GNL Historical Stock Prices, TEN Videos, HEPH Videos.