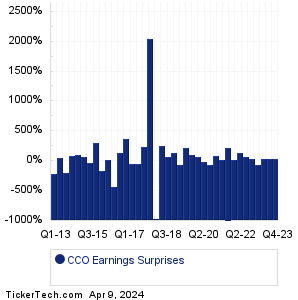

| Clear Channel Outdoor Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

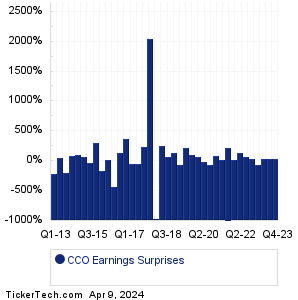

| Clear Channel Outdoor Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

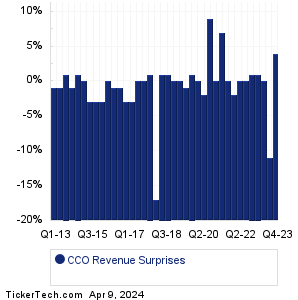

| CCO Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| CCO Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| CCO Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Neogen (NEOG): 4/9/2024 7:00 AMGreenidge Generation Hldg (GREE): 4/9/2024 After close Pricesmart (PSMT): 4/9/2024 After close WD-40 (WDFC): 4/9/2024 After close SMART Glb Hldgs (SGH): 4/9/2024 After close Aehr Test Systems (AEHR): 4/9/2024 After close Intensity Therapeutics (INTS): 4/9/2024 After close Delta Air Lines (DAL): 4/10/2024 6:30 AM Applied Digital (APLD): 4/10/2024 8:00 AM Pure Cycle (PCYO): 4/10/2024 After close More from the Next Earnings Dates Calendar Earnings History:CPI Aerostructures (CVU): 4/5/2024 8:40 PMCapStar Finl Hldgs (CSTR): 4/5/2024 5:00 PM Seelos Therapeutics (SEEL): 4/5/2024 After close Greenbrier Companies (GBX): 4/5/2024 8:30 AM Byrna Technologies (BYRN): 4/5/2024 8:00 AM Movano (MOVE): 4/4/2024 After close Kura Sushi USA (KRUS): 4/4/2024 After close Conifer Holdings (CNFR): 4/4/2024 After close Lamb Weston Hldgs (LW): 4/4/2024 8:30 AM Schnitzer Steel (RDUS): 4/4/2024 8:01 AM More from the Earnings History archive |

| Earnings Peers |

| Clear Channel Outdoor (CCO) is categorized under the Services sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

CHCI Historical Earnings CHDN Historical Earnings CHEF Historical Earnings CHGG Historical Earnings CHH Historical Earnings CHS Historical Earnings CHTR Historical Earnings CHUY Historical Earnings CIDM Historical Earnings CMG Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.