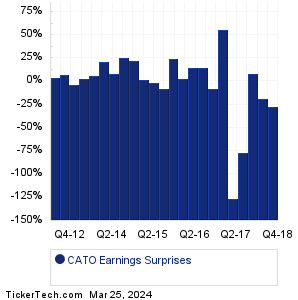

| Cato Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

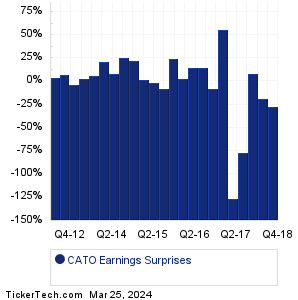

| Cato Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

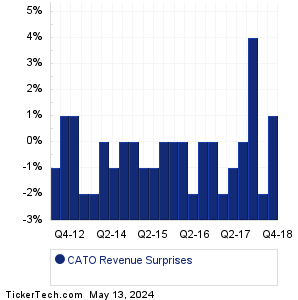

| CATO Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| CATO Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| CATO Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Radiant Logistics (RLGT): 3/25/2024 8:00 AMTheriva Biologics (TOVX): 3/25/2024 8:00 AM Bitcoin Depot (BTM): 3/25/2024 8:05 AM BuzzFeed (BZFD): 3/25/2024 After close Lucid Diagnostics (LUCD): 3/25/2024 After close Rekor Systems (REKR): 3/25/2024 After close Sanara MedTech (SMTI): 3/25/2024 After close Ampco-Pittsburgh (AP): 3/25/2024 After close Excelerate Energy (EE): 3/25/2024 5:00 PM Granite Ridge Resources (GRNT): 3/25/2024 5:00 PM More from the Next Earnings Dates Calendar Earnings History:Tandy Leather Factory (TLF): 3/22/2024 After closeMoleculin Biotech (MBRX): 3/22/2024 After close Luther Burbank (LBC): 3/22/2024 After close Zymeworks (ZYME): 3/22/2024 After close Pliant Therapeutics (PLRX): 3/22/2024 After close Union Bankshares (UNB): 3/22/2024 2:00 PM Solitario Zinc (XPL): 3/22/2024 9:30 AM United-Guardian (UG): 3/22/2024 9:00 AM Star Equity Hldgs (STRR): 3/22/2024 8:30 AM Servotronics (SVT): 3/22/2024 8:30 AM More from the Earnings History archive |

| Earnings Peers |

| Cato (CATO) is categorized under the Services sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

CAVA Historical Earnings CBRL Historical Earnings CCL Historical Earnings CCO Historical Earnings CHCI Historical Earnings CHDN Historical Earnings CHEF Historical Earnings CHGG Historical Earnings CHH Historical Earnings CHS Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.