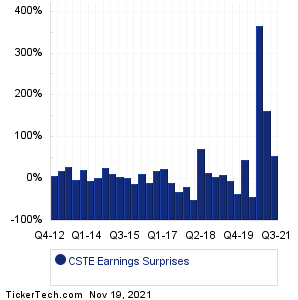

| Caesarstone Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for CSTE split history

|

|

|

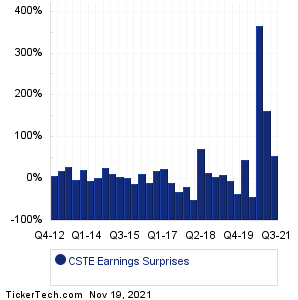

| Caesarstone Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Data adjusted for CSTE split history

|

|

|

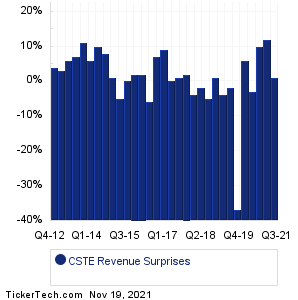

| CSTE Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| CSTE Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| CSTE Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Buckle (BKE): 11/19/2021 6:50 AMFoot Locker (FL): 11/19/2021 8:00 AM Franklin Wireless (FKWL): 11/20/2021 9:13 AM Zymergen (ZY): 11/22/2021 4:12 AM Cerence (CRNC): 11/22/2021 7:00 AM Spire (SR): 11/22/2021 7:00 AM Avaya Hldgs (AVYA): 11/22/2021 7:00 AM Twist Bioscience (TWST): 11/22/2021 8:00 AM Energy Fuels (UUUU): 11/22/2021 8:54 AM Procore Technologies (PCOR): 11/22/2021 9:04 AM More from the Next Earnings Dates Calendar Earnings History:BellRing Brands (BRBR): 11/18/2021 5:00 PMPost Holdings (POST): 11/18/2021 5:00 PM Universal Security (UUU): 11/18/2021 After close BioHiTech Global (BHTG): 11/18/2021 After close Caleres (CAL): 11/18/2021 After close ESCO Technologies (ESE): 11/18/2021 After close UGI (UGI): 11/18/2021 After close American Software (AMSWA): 11/18/2021 After close Palo Alto Networks (PANW): 11/18/2021 After close Globant (GLOB): 11/18/2021 After close More from the Earnings History archive |

| Earnings Peers |