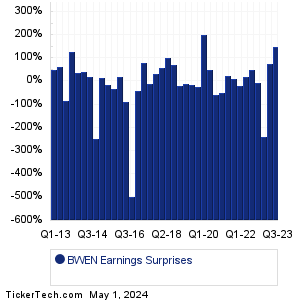

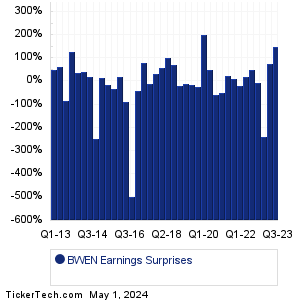

| Broadwind Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| Broadwind Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

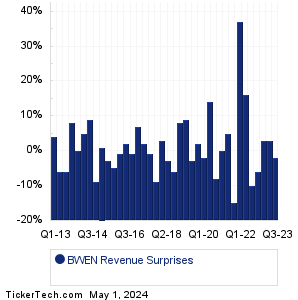

| BWEN Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| BWEN Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| BWEN Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Fortune Brands (FBIN): 5/15/2023 2:10 AMAltus Power (AMPS): 5/15/2023 6:00 AM Terran Orbital (LLAP): 5/15/2023 6:00 AM Science 37 Hldgs (SNCE): 5/15/2023 6:00 AM Rockwell Medical (RMTI): 5/15/2023 6:00 AM Novan (NOVN): 5/15/2023 6:30 AM Star Equity Hldgs (STRR): 5/15/2023 6:30 AM Modiv (MDV): 5/15/2023 6:45 AM Catalent (CTLT): 5/15/2023 7:00 AM Fulcrum Therapeutics (FULC): 5/15/2023 7:00 AM More from the Next Earnings Dates Calendar Earnings History:Willamette Valley (WVVI): 5/12/2023 6:00 PMTrean Insurance Group (TIG): 5/12/2023 5:00 PM Boston Omaha (BOC): 5/12/2023 After close Oxbridge Re Holdings (OXBR): 5/12/2023 After close Network-1 Technologies (NTIP): 5/12/2023 After close CEL-SCI (CVM): 5/12/2023 After close Citius Pharma (CTXR): 5/12/2023 After close Comstock Holding Co (CHCI): 5/12/2023 After close FG Finl Gr (FGF): 5/12/2023 After close Generation Income (GIPR): 5/12/2023 After close More from the Earnings History archive |

| Earnings Peers |

| Broadwind (BWEN) is categorized under the Industrials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

BWXT Historical Earnings CACI Historical Earnings CAI Historical Earnings CAR Historical Earnings CASS Historical Earnings CAT Historical Earnings CBZ Historical Earnings CCS Historical Earnings CDK Historical Earnings CECE Historical Earnings |

Recommended: ENLV Average Annual Return, ADBE market cap history, Funds Holding WAVX.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 7.8%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 7.8%.