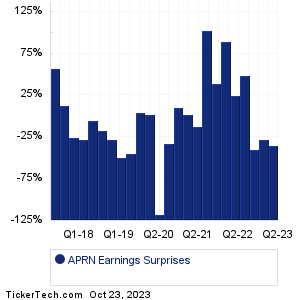

| Blue Apron Hldgs Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

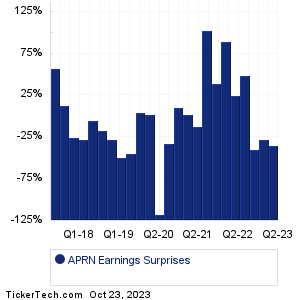

| Blue Apron Hldgs Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

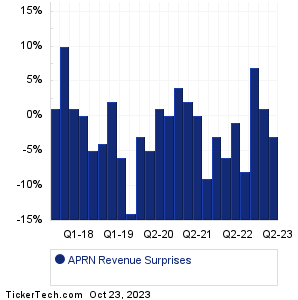

| APRN Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| APRN Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| APRN Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Bank of Hawaii (BOH): 10/23/2023 6:45 AMHope Bancorp (HOPE): 10/23/2023 7:00 AM HBT Finl (HBT): 10/23/2023 7:05 AM Dynex Cap (DX): 10/23/2023 8:00 AM Bank of Marin (BMRC): 10/23/2023 8:30 AM Acme United (ACU): 10/23/2023 9:00 AM Packaging Corp of America (PKG): 10/23/2023 After close Trustco Bank (TRST): 10/23/2023 After close Cadence Design Sys (CDNS): 10/23/2023 After close Cleveland-Cliffs (CLF): 10/23/2023 After close More from the Next Earnings Dates Calendar Earnings History:Ames National (ATLO): 10/20/2023 After closeMetroCity Bankshares (MCBS): 10/20/2023 10:00 AM Virginia Ntl Bankshares (VABK): 10/20/2023 8:00 AM World Acceptance (WRLD): 10/20/2023 7:30 AM Berkshire Hills Bancorp (BHLB): 10/20/2023 7:30 AM OFG Bancorp (OFG): 10/20/2023 7:30 AM First BanCorp (FBP): 10/20/2023 7:00 AM Interpublic Gr of Cos (IPG): 10/20/2023 7:00 AM Huntington Bancshares (HBAN): 10/20/2023 7:00 AM American Express (AXP): 10/20/2023 7:00 AM More from the Earnings History archive |

| Earnings Peers |

| Blue Apron Hldgs (APRN) is categorized under the Services sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

ARHS Historical Earnings ARKO Historical Earnings ARKR Historical Earnings ARMK Historical Earnings ASO Historical Earnings ASPU Historical Earnings ATGE Historical Earnings ATUS Historical Earnings AUD Historical Earnings AZO Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 8.1%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 8.1%.