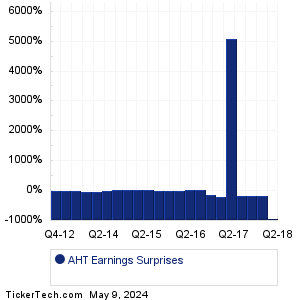

| Ashford Hospitality Trust Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

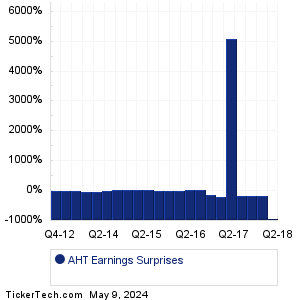

| Ashford Hospitality Trust Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

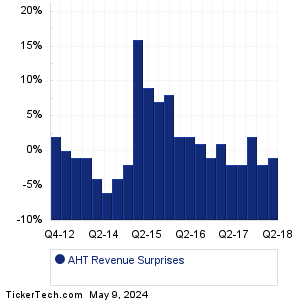

| AHT Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| AHT Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| AHT Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:22nd Century Group (XXII): 3/28/2024 6:00 AMMSC Industrial Direct Co (MSM): 3/28/2024 6:30 AM Walgreens Boots Alliance (WBA): 3/28/2024 7:00 AM REX American Resources (REX): 3/28/2024 7:00 AM OptimizeRx (OPRX): 3/28/2024 7:00 AM Bioventus (BVS): 3/28/2024 7:00 AM Altisource Portfolio (ASPS): 3/28/2024 7:00 AM Marketwise (MKTW): 3/28/2024 7:00 AM Data Storage (DTST): 3/28/2024 7:00 AM EVgo (EVGO): 3/28/2024 8:00 AM More from the Next Earnings Dates Calendar Earnings History:Creative Media (CMCT): 3/27/2024 7:20 PMChemours (CC): 3/27/2024 5:25 PM American Shared Hospital (AMS): 3/27/2024 5:12 PM inTest (INTT): 3/27/2024 5:07 PM Sonim Technologies (SONM): 3/27/2024 After close Vaxxinity (VAXX): 3/27/2024 After close Allied Gaming (AGAE): 3/27/2024 After close Microbot Medical (MBOT): 3/27/2024 After close Orchestra BioMed Hldgs (OBIO): 3/27/2024 After close Kingstone Companies (KINS): 3/27/2024 After close More from the Earnings History archive |

| Earnings Peers |

| Ashford Hospitality Trust (AHT) is categorized under the Financials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

AIG Historical Earnings AIRC Historical Earnings AIV Historical Earnings AIZ Historical Earnings AJG Historical Earnings AJX Historical Earnings AKR Historical Earnings ALBT Historical Earnings ALEX Historical Earnings ALL Historical Earnings |

Recommended: BC Split History, GDRX Stock Predictions, Top Ten Hedge Funds Holding VSEC.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.