| AMRS Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| AMRS Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

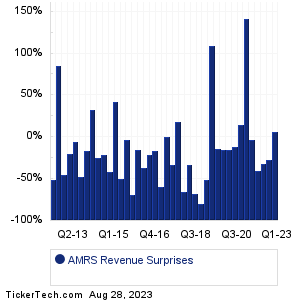

| AMRS Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| AMRS Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| AMRS Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Lifevantage (LFVN): 8/28/2023 After closeHeico (HEI): 8/28/2023 After close Heico (HEI): 8/28/2023 After close JOANN (JOAN): 8/28/2023 After close Atmus Filtration Techs (ATMU): 8/29/2023 5:54 AM Donaldson (DCI): 8/29/2023 6:00 AM Shoe Carnival (SCVL): 8/29/2023 6:15 AM Best Buy Co (BBY): 8/29/2023 7:00 AM JM Smucker (SJM): 8/29/2023 7:00 AM Catalent (CTLT): 8/29/2023 7:00 AM More from the Next Earnings Dates Calendar Earnings History:Green Brick Partners (GRBK): 8/27/2023 After closeMedalist Diversified REIT (MDRR): 8/25/2023 5:00 PM PharmaCyte Biotech (PMCB): 8/25/2023 5:00 PM Akebia Therapeutics (AKBA): 8/25/2023 8:09 AM Magenta Therapeutics (MGTA): 8/25/2023 8:00 AM Hibbett (HIBB): 8/25/2023 6:30 AM Wireless Telecom Group (WTT): 8/25/2023 6:00 AM U.S. Gold (USAU): 8/25/2023 6:00 AM NEXTracker (NXT): 8/25/2023 4:13 AM Koss (KOSS): 8/24/2023 5:00 PM More from the Earnings History archive |

| Earnings Peers |

| Amyris (AMRS) is categorized under the Materials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

AP Historical Earnings APD Historical Earnings APOG Historical Earnings AQMS Historical Earnings ARCH Historical Earnings AREC Historical Earnings ARNC Historical Earnings ASH Historical Earnings ASIX Historical Earnings ASPN Historical Earnings |

Recommended: SCE Options Chain, PSXP market cap history, UHS shares outstanding history.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 7.8%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 7.8%.