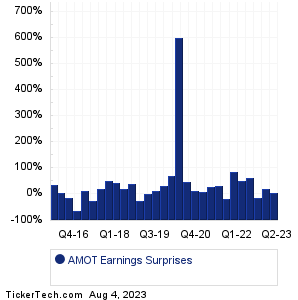

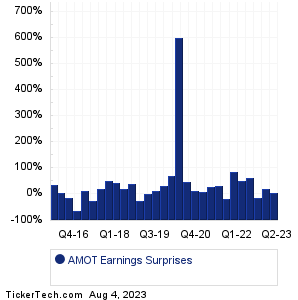

| Allied Motion Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| Allied Motion Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| AMOT Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| AMOT Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| AMOT Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Interface (TILE): 8/4/2023 5:30 AMEvergy (EVRG): 8/4/2023 6:00 AM XPO (XPO): 8/4/2023 6:00 AM Corebridge Financial (CRBG): 8/4/2023 6:00 AM Proto Labs (PRLB): 8/4/2023 6:00 AM Gray Television (GTN): 8/4/2023 6:00 AM Amneal Pharmaceuticals (AMRX): 8/4/2023 6:00 AM Dixie Gr (DXYN): 8/4/2023 6:00 AM Marcus & Millichap (MMI): 8/4/2023 6:10 AM LyondellBasell Industries (LYB): 8/4/2023 6:30 AM More from the Next Earnings Dates Calendar Earnings History:Ziff Davis (ZD): 8/3/2023 6:44 PMAlliant Energy (LNT): 8/3/2023 6:00 PM RLJ Lodging (RLJ): 8/3/2023 5:33 PM RGC Resources (RGCO): 8/3/2023 5:30 PM Air Transport Services Gr (ATSG): 8/3/2023 5:26 PM AES (AES): 8/3/2023 5:18 PM Nine Energy Service (NINE): 8/3/2023 5:05 PM Tucows (TCX): 8/3/2023 5:05 PM Vector Group (VGR): 8/3/2023 5:03 PM NN (NNBR): 8/3/2023 5:00 PM More from the Earnings History archive |

| Earnings Peers |

| Allied Motion (AMOT) is categorized under the Industrials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

AMRC Historical Earnings AMSC Historical Earnings AMWL Historical Earnings APG Historical Earnings APH Historical Earnings AQUA Historical Earnings ARC Historical Earnings ARCB Historical Earnings ARIS Historical Earnings ARRY Historical Earnings |

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 7.8%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 7.8%.