| AEL Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

| AEL Earnings Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

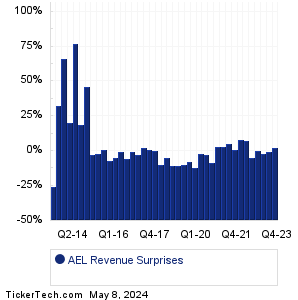

| AEL Revenue Surprises | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| AEL Current Stock Quote |

Get Dividend Alerts Get SEC Filing Alerts |

| AEL Stock Price Chart |

| Next Earnings Dates |

Next Earnings Date Calendar:Archer-Daniels Midland (ADM): 3/12/2024 7:00 AMTupperware Brands (TUP): 3/12/2024 7:00 AM BioXcel Therapeutics (BTAI): 3/12/2024 7:00 AM Priority Tech Holdings (PRTH): 3/12/2024 7:00 AM Chicago Atlantic Real (REFI): 3/12/2024 7:00 AM Hagerty (HGTY): 3/12/2024 7:00 AM Bioventus (BVS): 3/12/2024 7:00 AM PowerFleet (PWFL): 3/12/2024 7:00 AM Lifetime Brands (LCUT): 3/12/2024 7:00 AM Kohl's (KSS): 3/12/2024 7:00 AM More from the Next Earnings Dates Calendar Earnings History:Energy Fuels (UUUU): 3/11/2024 6:00 PMNN (NNBR): 3/11/2024 5:05 PM Smart Sand (SND): 3/11/2024 5:00 PM Fuel Tech (FTEK): 3/11/2024 After close Casey's General Stores (CASY): 3/11/2024 After close NET Power (NPWR): 3/11/2024 After close PLAYSTUDIOS (MYPS): 3/11/2024 After close NGM Biopharmaceuticals (NGM): 3/11/2024 After close Heritage Insurance Hldgs (HRTG): 3/11/2024 After close Olema Pharmaceuticals (OLMA): 3/11/2024 After close More from the Earnings History archive |

| Earnings Peers |

| American Equity Inv (AEL) is categorized under the Financials sector; to help you further research past earnings across stocks, below are some other companies in the same sector:

AFBI Historical Earnings AFCG Historical Earnings AFG Historical Earnings AFIN Historical Earnings AFL Historical Earnings AGM Historical Earnings AGNC Historical Earnings AGO Historical Earnings AHH Historical Earnings AHT Historical Earnings |

Recommended: WP market cap history, Institutional Holders of CTIC, LGO Videos.

Click the button below for your complimentary copy of Your Early Retirement Portfolio: Dividends Up to 9.5%—Every Month—Forever.

You'll discover the details on 4 stocks and funds that pay you massive dividends as high as 9.5%.